What is BAS and when do I have to pay it?

Business Activity Statements, better known as BAS, are a taxation requirement for any Australian business making $75,000 or more in a financial year.

The $75,000 threshold is based on your sales, sometimes referred to as turnover. Expenses and deductions are not taken into account for hitting the $75,000. It is the gross income of your business only.

As soon as you hit the $75,000 or you anticipate you will hit this threshold your business needs to register for GST. You cannot charge or claim GST unless you have registered. This is an important step. You will also need to decide the frequency of your BAS lodgement, either monthly or quarterly.

Charging and Claiming GST

BAS doesn’t need to be scary. Most business owners see it as a daunting and costly task. It’s important to remember that the business doesn’t pay BAS. Your clients and customers pay this tax. Your role is to collect the 10% tax.

When your business has hit the threshold turnover, you can add 10% tax to your sales invoices. You will also need issue Tax Invoices for your sales and include specific information. As a bookkeeper I can help ensure your invoices are ATO compliant.

You will also need to start tracking the 10% GST on your purchases. This is the important part as you can claim the tax as a deduction. Certain purchases do not attract any GST so it’s important to be aware when processing your expenses.

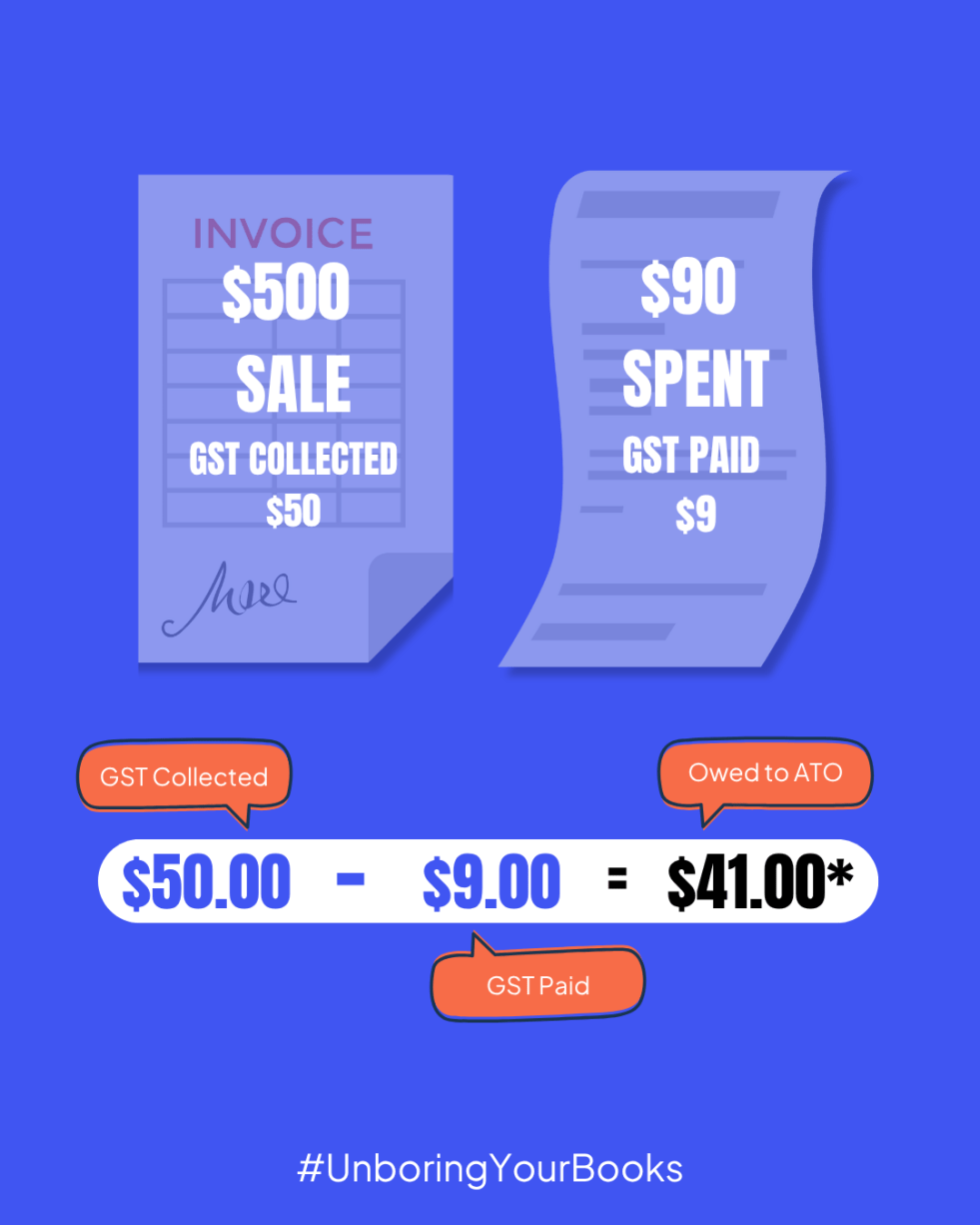

The example shows a $500 sale where you have added 10% and collected $50 in GST. You have also purchased $99 worth of goods, $9 of which is GST.

To calculate the amount payable in BAS you need to subtract the GST paid from the GST collected. In this example $41 is payable to the ATO.

Some benefits to paying BAS is if your business requires a lot of upfront purchases. In this case you may be elligible for a tax credit. I.e. the ATO will owe you money.

What is PAYG?

PAYG (or Pay As You Go) are instalments towards income tax. PAYG is relevant for sole traders, but will also be paid for any employees of your business. The ATO bundles PAYG along with BAS so you only have one payment to worry about. The ATO will send PAYG instalment letters, and it’s a good idea to pay them. This will save you a bigger income tax bill at year end. The ATO has provided a handy calculator to estimate your income tax.

Cash or Accrual

One final decision you will need to make as a BAS paying business is whether your accounting system will be cash or accrual basis. The basis will set the timing of how sales and expenses are reflected in your books.

Cash Basis – Recognise income and expenses when money changes hands. Cash accounting has nothing to do with physical cash. Money can still be paid and spent electronically. It’s a simpler form of accounting and most small business operate on cash accounting system. The downside is it can paint an innacurate picture of your finances.

Accrual Basis – Recognise income when an invoice is raised and expense when a bill is entered, even if it won’t be paid straight away. Accrual systems are much better for projecting cash position, but you need to keep an eye on invoices and not just your bank account.

Summary

BAS does not need to be an icky affair. There are a few simple steps that you need to take and a BAS Agent Bookkeeper I can help you through these steps.

✅ Calculate if you will hit the $75,000 sales threshold

✅ Register for GST

✅ Decide your BAS frequency

✅ Choose cash or accrual accounting basis

✅ Add 10% GST to your sales and start tracking GST on purchases

✅ Issue compliant Tax Invoices to customers

✅ Pay your BAS and PAYG at the same time

Leave a comment